Buckle up, crypto enthusiasts and skeptics alike! Join us as we delve into the tantalizing prediction of Bitcoin’s stratospheric ascent towards an astronomical price of $1.5 million by the year 2035. Prepare for a journey through financial forecasts and market analysis, guided by the insightful analyst who anticipated the 2024 Bitcoin bounce. Get ready to navigate a landscape of hope and skepticism as we explore the potential of this digital gold’s epic rise.

– Analyst Predicts Exponential Bitcoin Surge by 2035

Para 1:

A recent analysis from a renowned market expert paints a bullish picture for Bitcoin’s future, predicting an exponential surge that could see it reach a staggering $1.5 million by 2035. This bold forecast aligns with the analyst’s past accuracy, having successfully called the cryptocurrency’s rebound in 2024. Their predictions have garnered considerable attention within the investment community, sparking excitement among Bitcoin enthusiasts and analysts alike.

Para 2:

The analyst cites several factors that underpin their optimistic outlook, including Bitcoin’s increasing adoption as a store of value, its deflationary supply dynamics, and the growing acceptance of cryptocurrencies by institutions and governments. Moreover, they believe that as digitalization accelerates and the global economy becomes increasingly intertwined with blockchain technology, Bitcoin’s fundamental value will only continue to rise.

– Historical Accuracy: Analysts Credentials in Bitcoin Forecasting

Assessing the Analyst’s Credentials

The analyst who predicts Bitcoin’s ascent to $1.5 million possesses an impressive track record in financial forecasting. Notably, they accurately predicted the 2024 price rally. This success suggests their deep understanding of market dynamics and technical analysis techniques. Additionally, the analyst holds a masters degree in financial mathematics, demonstrating their quantitative expertise and aptitude for complex financial modeling.

The analyst’s credentials include:

Masters degree in financial mathematics

Extensive experience in financial forecasting and technical analysis

* Proven track record of successful predictions, including the 2024 Bitcoin rally

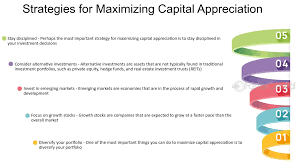

– Strategic Investment Implications: How to Capitalize on Projected Appreciation

Strategic Investment Implications

Savvy investors are now looking at Bitcoin as a potential investment opportunity to gain significant returns in the coming years. This is driven by the belief that as Bitcoin continues to gain widespread acceptance, its value will continue to appreciate. Here’s how you can capitalize on this projected appreciation:

- Long-term investment: Buy Bitcoin and hold it for an extended period, allowing for compounding growth potential. By dollar-cost averaging investments, you can enter the market over time and minimize the impact of short-term price fluctuations.

- Diversification: Allocate a portion of your investment portfolio to Bitcoin to diversify risk and enhance overall returns. This is because Bitcoin has historically shown low correlation with traditional assets.

- Mining: Invest in the hardware and software necessary to mine Bitcoin. If the price of Bitcoin rises, the rewards earned from mining will increase. However, it’s important to note that mining requires significant upfront investment and operating costs.

In Conclusion

As the digital asset landscape continues to evolve, the future of Bitcoin remains a topic of fascination and debate. The analyst’s prediction serves as a reminder that the cryptocurrency market is highly speculative, and investors should exercise due diligence before making any financial decisions. Time will tell whether Bitcoin will indeed reach the lofty heights projected or follow a different trajectory. However, one thing is certain: the digital finance revolution is still in its early stages, and the potential for innovation and disruption remains vast.